The Reserve Bank of India (RBI), as the central banking institution of India, is the backbone of the Indian financial system. As the custodian of the country’s economic and financial stability, it plays a crucial role in India’s economic development and smooth functioning of the entire banking sector. This article of NEXT IAS aims to study in detail the Reserve Bank of India (RBI), its origin, evolution, structure, functions, and more.

About Reserve Bank of India (RBI)

- The Reserve Bank of India, abbreviated as the RBI, is the Central Bank of India, meaning it is the apex body in the Indian financial system.

- It is owned by the Union Ministry of Finance.

- It acts as a regulatory body, responsible for the regulation of the Indian banking system as well as the control, issuing, and maintaining money supply in the Indian economy.

Objectives of Reserve Bank of India (RBI)

Some of its major objectives can be seen as follows:

- To regulate the issue of banknotes

- To maintain reserves with a view to securing monetary stability and

- To operate the credit and currency system of the country to its advantage.

- To maintain price stability while keeping in mind the objective of growth.

History of Reserve Bank of India (RBI)

The Reserve Bank of India was established to tackle the economic turmoil that occurred after World War-I. The timeline of origin and evolution of the Reserve Bank of India (RBI) can be seen as follows:

| Year | Event |

|---|---|

| 1926 | The 1926 Royal Commission on Indian Currency and Finance, also known as the Hilton Young Commission, recommended setting up a Central Bank for India. |

| 1934 | The Central Legislative Assembly accepted the recommendation and passed the Reserve Bank of India Act, 1934, which provides the statutory basis for the functioning of the Bank. |

| 1935 | As per the provision of the RBI Act, the RBI was established in Calcutta and commenced its operations on 1st April, 1935. |

| 1937 | In 1937, the RBI was permanently moved from Calcutta to Mumbai, where its current Central Office is located. |

| 1949 | In 1949, the RBI, which was held by private stakeholders till now, was nationalized. |

Note: India was the first British colony to have its own Central Bank.

Nationalization of Reserve Bank of India (RBI)

The Reserve Bank of India (RBI), as established in 1935, was, initially, a privately owned entity. It meant that its share capital was divided into shares, owned by private individuals and institutions.

However, later, the Government of India passed the Reserve Bank of India (Transfer to Public Ownership) Act, 1948. As per its provisions, the ownership of the Reserve Bank of India was transferred from private entities to the government. This is called the nationalization of the RBI, which transformed it from a privately owned entity to a fully government-owned entity.

After nationalization in 1949, it emerged as the Central Bank of India and no more remained a ‘bank’ in the technical sense.

Branches and Offices of RBI

Various branches and offices of RBI can be seen hierarchically as follows:

Central Office of RBI

The Central Office of the Reserve Bank of India is the main office and headquarters of the RBI. This is the office where the RBI Governor sits and the whole organization of the RBI is controlled from.

Zonal Offices of RBI

The RBI has 4 Zonal Offices, located in

- Kolkata – represents the East Region

- Mumbai – represents the West Region

- Delhi – represents the North Region

- Chennai – represents the South Region

Regional Offices of RBI

The Reserve Bank of India (RBI) has about 22 regional offices, which play a crucial role in the functioning of the RBI at the regional level. These offices are mostly located in the capital cities of the states.

Other Offices of RBI

The RBI has other offices in prominent cities across India, which perform specific tasks like:

- Specialized departments like rural planning or agricultural credit.

- Training centers for bankers.

- Oversight of specific financial institutions.

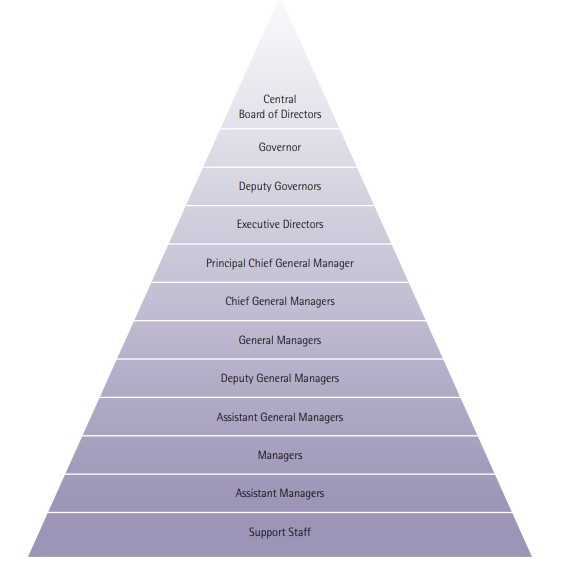

Structure of Reserve Bank of India (RBI)

The structure of the Reserve Bank of India (RBI) can be seen as follows:

Central Board of Directors of RBI

The Central Board of Directors is the main committee of the Reserve Bank of India, responsible for its overall control and direction. It is a 21-member body, comprising the following members:

- Official Directors – They include:

- The Governor of the Reserve Bank of India.

- Not more than 4 Deputy Governors (for a tenure of not more than 5 years)

- Non-Official Directors – They include

- 10 Directors from various fields, nominated by the Government of India (for a tenure of 4 years)

- 4 Directors representing the 4 Local Boards of the Reserve Bank of India (1 Director nominated by each of the 4 Local Boards – Mumbai, Kolkata, Chennai, and Delhi)

- 2 Government officials nominated by the Government of India

Local Boards of RBI

- The 4 Zonal Offices of the Reserve Bank of India are controlled by a Local Board for each.

- Each of these local boards consists of 5 members who represent regional interests and the interests of cooperative and indigenous banks.

Key Facts about RBI

| – The first Governor of the RBI was Sir Osborne Smith (1935-37). – The first Indian Governor of the RBI was C.D. Deshmukh (1943-49) – Manmohan Singh is the only Prime Minister of India who, till now, has also served as the Governor of the RBI. – The emblem of the RBI is a Tiger and a Palm Tree. – The Reserve Bank of India has 4 fully owned subsidiaries: a. Deposit Insurance and Credit Guarantee Corporation (DICGC) b. Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL) c. Reserve Bank Information Technology Private Limited (ReBIT) d. Indian Financial Technology and Allied Services (IFTAS) |

Functions of Reserve Bank of India (RBI)

Major functions of the RBI can be seen under the following 2 heads:

Monetary Functions of RBI

Monetary Functions of the Reserve Bank of India include those functions which are concerned with money and money supply in the economy. Major functions coming in this category include:

- Issuer of Bank Notes: The Reserve Bank of India has the monopoly of issuing currency notes except for 1 Rupee note and coins.

- The 1 Rupee note and the coins of all denominations are minted and issue by the Government of India, not the RBI. But, they are circulated by the RBI.

- The RBI issues currency notes under a system called Minimum Reserve System.

- Banker to the Government: The RBI acts as a banking agent and financial advisor to the Central as well as the State Governments. In this capacity, the RBI:

- Manages Government accounts and treasuries.

- Keeps deposits of the Government.

- Lends to the Governments without any interest for the short term

- Buys and sells Government Securities (G-Secs) on the Government’s behalf.

- Gives monetary and financial advice to the Governments.

- Bankers’ Bank: The RBI is the banker of all Scheduled commercial banks (SCBs). In this capacity, it performs the following functions:

- Keeps the reserves of banks in the form of Cash Reserve Ratio (CRR) with itself.

- Provides financial assistance to banks against mortgaged securities

- Rediscounts Bills of Exchange.

- Lender of Last Resort: It also acts as a lender of last resort for the Scheduled Commercial Banks (SCBs). Usually, banks and other financial institutions borrow and lend among themselves to meet their financial needs. But, in times of crisis, the SCBs approach the RBI to get financial assistance.

- Custodian and Manager of Foreign Exchange Reserves: In order to stabilize the external value of Indian currency, the RBI maintains the reserves of foreign currencies to stabilize the exchange rate.

- This function of the RBI also helps promote international trade.

- Controller of Credit or Money Supply: It uses its monetary policy tools to control the volume of money supply according to the economic situation of the nation.

- This helps in controlling inflation and deflation and hence stabilizing the general price level in the economy.

General Functions of RBI

The General Functions of the RBI include functions related to general regulation and promotion of the banking system so as to maintain the health and growth of the banking system in the country. Major functions included in this category are as follows:

- Regulator of the Banks: The RBI Act of 1934 and the Banking Regulation Act of 1949 entrust the RBI with the powers to regulate the banks in the country. In this capacity, the RBI performs functions such as:

- Licensing banks,

- Prescribing minimum requirements of paid-up capital and reserves, etc.

- Promotional Functions: The RBI works towards the promotion of the Indian Financial System through functions such as

- Enabling expansion of the Commercial Banks in terms of their branches in the country or aboard,

- Promoting baking habits of people,

- Promoting financial inclusion,

- Consumer education and protection,

- Promoting Digital India initiatives in financial sector, etc.

Currency Notes Printing and Coins Minting in India

| – Currency Notes: Currency Notes are printed in 4 presses in India – Nasik (Maharashtra), Dewas (Madhya Pradesh), Mysore (Karnataka), and Salboni (West Bengal) a. Of these, Nasik and Dewas presses are owned by the Government of India; whereas, Mysore and Salboni presses are owned by the RBI through its wholly owned subsidiary Bharatiya Reserve Bank Note Mudran Ltd. (BRBNML). – Coins: Coins are minted in 4 mints located in Mumbai, Hyderabad, Calcutta and Noida. a. All the 4 mints are owned by the Government of India. – As per the Indian Coinage Act of 1906, Coins can be issued up to the denomination of ₹1000. – As per the RBI Act of 1934, Currency Notes can be issued up to the denomination of ₹10,000. – The ₹1 note is the only currency note which bears the signature of the Finance Secretary of the Government of India, and not of the Governor of the RBI. a. All other notes bear the signature of the Governor of the RBI. |

Minimum Reserve System

In 1957, the RBI adopted the Minimum Reserve System for issuing currency notes. As per this system, to issue money, the RBI maintains Gold and Foreign Currency Reserves of worth ₹200 crores as a backup.

Note: Out of this reserve, a minimum of ₹115 crores should be in Gold.

Publications of RBI

RBI, from time to time, conducts various surveys and publishes various reports to gauge the pulse of the economy. Some of the major publications of the RBI include:

- Financial Stability Report (Half-Yearly): It reflects the collective assessment of the risks to financial stability and the resilience of the financial system. The Report also discusses issues relating to the development and regulation of the financial sector.

- Monetary Policy Report (Half-Yearly): It is published by the Monetary Policy Committee (MPC) of the Reserve Bank of India.

- It plays a crucial role in determining the policy rate required to achieve the inflation target.

- Consumer Confidence Survey (Quarterly): It compiles qualitative responses from households, regarding their sentiments on general economic conditions, overall price situation, employment, income, spending scenario, etc.

- Inflation Expectations Survey of Households (Quarterly): It compiles qualitative responses from households on price changes (general prices as well as prices of specific product groups) in the next three months as well as in the next one year and quantitative responses on current, three-month ahead and one-year ahead inflation rates.

- The results of this survey is used as one of the important inputs for the formulation of the monetary policy.

- Report on Foreign Exchange Reserves (Half-Yearly): It contains the developments regarding movement of foreign exchange reserves, information on the external liabilities vis-à-vis the reserves, adequacy of reserves, objectives of reserve management, statutory provisions, risk management practices, information on transparency and disclosure practices, etc.

- Digital Payments Index (DPI): It captures the extent of digitisation of payments across the country.

- The RBI-DPI is based on 5 broad parameters:

- Payment Enablers

- Payment Infrastructure – Demand-side Factors

- Payment Infrastructure – Supply-side Factors

- Payment Performance

- Consumer Centricity

- The RBI-DPI is based on 5 broad parameters:

Incomes and Expenditures of RBI

Major components of the incomes and expenditures of the RBI can be seen under the following 2 heads:

RBI’s Incomes

Most part of the RBI’s income mainly comes from its operations in financial markets. They include:

- Incomes form buying or selling foreign exchange.

- Incomes from Open Market operations (to prevent the rupee from appreciating).

- Incomes from government securities it holds.

- Returns from its foreign currency assets that are invested in the bonds of foreign central banks or top-rated securities.

- Returns from deposits with other central banks or the Bank for International Settlement (BIS).

- Returns from From lending to banks for very short tenures

- Management commission on handling the borrowings of State Governments and the Central Government.

RBI’s Expenditures

Major components forming part of expenditures of the Reserve Bank of India include:

- Expenditures on printing of currency notes

- Salary of its staff

- Giving commissions to banks for undertaking transactions on behalf of the government

- Giving commissions to primary dealers for underwriting some of these borrowings.

Issue of RBI Surplus Transfer

What is RBI Surplus?

The RBI’s total expenditure is only about 1/7th of its total net income. The difference between RBI’s income and expenditure is known as RBI Surplus.

Out of its total surplus, RBI holds some amount to itself as equity capital to maintain its creditworthiness and pays the rest to the government.

Government’s Stance on Surplus Transfer

The government is of the opinion that the Reserve Bank of India should pay more dividends. The reasoning given by the government is that the building up of buffers such as the Contingency Fund and Asset Reserve by the Central Bank has been far in excess of what is required to maintain creditworthiness.

RBI’s Stance on Surplus Transfer

The Reserve Bank of India, on the other hand, says that increasing the dividend payment to the government can prove to be inflationary as there will be more money in the market and may harm its major task of macroeconomic stability.

It also reasons that the surplus is used to cover a situation where the rupee appreciates against one or more of the currencies or if there is a decline in the rupee value of gold.

Advantages of Surplus Transfer

- The government can utilize funds for public spending, which could lead to a revival in demand and boost economic activity and thus help deal with economic slowdown.

- It can help the government cut back on planned borrowings, thereby providing space for private companies to raise money from markets. This, in turn, would do away the risk of crowding out of private investments.

- It can be utilized to provide capital to government-owned banks in form of recapitalization. This will help strengthen the health of the banking system.

Disadvantages of Surplus Transfer

- It reduces RBI’s Buffer against externalities such as potential threats from financial shocks, and the need to ensure financial stability and provide confidence to the markets.

- Maintaining a sufficient buffer of the surplus is crucial for the autonomy of the Reserve Bank of India so that it doesn’t depend on the Government in times of financial stress.

- Surplus transfers can cause inflationary situations if government spending is not done in a proper manner.

Autonomy of Reserve Bank of India (RBI)

As the Central Bank of India, the role of the Reserve Bank of India is crucial in promoting financial stability and economic growth. Thus, it must have a significant degree of autonomy in its functioning. However, some factors seem to hamper the autonomy of the RBI. These factors the suggested way ahead are explained in the sections that follow.

Factors Hampering Autonomy of RBI

- The Colonial-era RBI Act of 1934 provides the government sweeping powers to control the Reserve Bank of India the way it wants. For example:

- Section 30 of the RBI Act allows the government to supersede the RBI’s Central Board.

- Section 58 circumscribes the powers of the Central Board to make regulations only with the previous sanction of the Central Government.

- Section 7(1) says that the Union government can give directions to the central bank, after consultation with the RBI Governor in the public interest.

- According to a report, since independence, 7 out of every 10 RBI Governors have been former Finance Ministry officials. This raises the question of the independent functioning of the Reserve Bank of India.

- The Central Board of Directors, the highest decision-making body of the RBI, consists of 21 members, of which 12 members are nominated by the Union government. This gives the government a large say in the functioning of the Reserve Bank of India.

- The government frequently asks the Reserve Bank of India to ease lending rules under its Prompt Corrective Action (PCA) Framework, as it could help reduce pressure on MSMEs and Power Companies through credit availability. This jeopardizes the RBI’s efforts to deal with the country’s Non-Performing Asset (NPA) Crisis.

- The issue of increasing RBI Surplus Transfer has been also hampering the autonomy of RBI.

Way Ahead

The tussle between the Reserve Bank of India and the government can impact the image of India as a stable market as investors require long-term policy consistency. Thus it is necessary that the government should respect the mandate given to the Reserve Bank of India as a regulator of the banks. At the same time, the RBI must also understand that constitutionally it is a part of the government and not a completely independent body. Thus, both sides should maintain a fine balance so as to ensure the objectives of stable economic growth and welfare of the people.

Conclusion

The Reserve Bank of India (RBI) plays an indispensable role in India’s economic well-being. Its commitment to monetary stability, financial regulation, and inclusive growth ensures a strong foundation for the nation’s financial system. As India navigates an evolving economic landscape, the RBI’s continued vigilance and adaptability will be crucial in steering the country towards a prosperous future.

FAQs on RBI

Who is the Governor of the Reserve Bank of India?

Shri Shaktikanta Das is serving as the current & 25th Governor of the RBI.

Is RBI a Statutory Body?

Yes, it is a statutory body. It was established under the Reserve Bank of India Act, 1934, which defines the RBI’s powers and functions.

Where is the Reserve Bank of India Situated?

The central office of the RBI, which functions as its headquarters, is located in Mumbai.