Commercial Banks (CBs), as a significant part of the Banking System in India, play a pivotal role in the Indian financial sector. They are the backbone of the economy, providing the financial resources necessary for growth and development. This article of NEXT IAS aims to study Commercial Banks (CBs) in detail, including their classification, types, roles & significance, and other related concepts.

What are Commercial Banks?

- Commercial Banks (CBs) refer to those banks under the Banking System in India that run on a commercial basis. It means that they operate and offer services to earn a profit.

- They are regulated under the Banking Regulation Act, 1949.

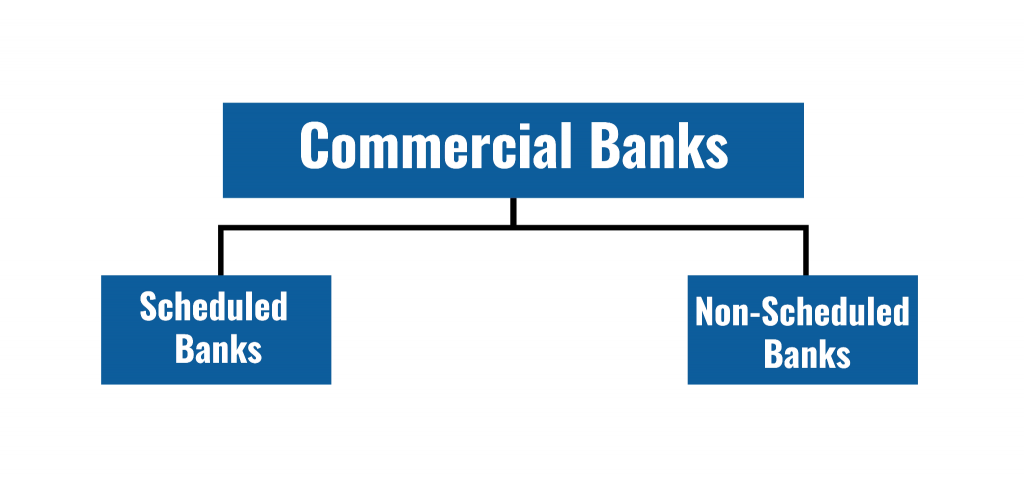

Structure of Commercial Banks in India

As per the current structure of Commerical Banks in India, they are divided into two categories:

Scheduled Commercial Banks (SCBs)

SCBs refer to those Commercial Banks under the Banking System in India that are listed in the 2nd Schedule of the Reserve Bank of India Act, 1934 (RBI Act, 1934).

Non-Scheduled Commercial Banks (NSCBs)

NSCBs refer to those that don’t meet the criteria to be included in the 2nd Schedule of the Reserve Bank of India Act, 1934 (RBI Act, 1934). Being excluded from the schedule means they operate under a different set of regulations as compared to SCBs.

Difference between Scheduled Commercial Banks and Non-Scheduled Commercial Banks

| Basis of Difference | Scheduled Commercial Banks (SCBs) | Non-Scheduled Commercial Banks (NSBCs) |

|---|---|---|

| Meaning | Listed in the second schedule of the RBI Act 1934. | Not mentioned in the second schedule of the RBI Act 1934. |

| Criteria | – Should have a paid-up capital of `5 lakhs or more. – Have to ensure that its affairs are not conducted in a manner detrimental to the interest of its depositors. | – No fixed criteria as such. |

| Regulatory Requirements | – Have to keep CRR deposits with the Reserve Bank of India. – Required to file their returns on a periodic basis. | – Have to maintain CRR deposits with themselves. – No requirements for filing returns as such. |

| Rights Available | – Authorized to borrow funds from the RBI. – Can apply to join the clearinghouse. – Can avail of the facility of rediscount of first-class exchange bills from RBI. | – Usually, not authorized to borrow funds from the RBI. However, they can borrow from the RBI under emergency conditions. – Not eligible for membership in the clearinghouse. – Facility of rediscounting exchange bills from RBI is not available for them. |

| Risk | – They are financially stable and are unlikely to hurt the rights of the depositors. | – These banks are riskier to do business. |

| Examples | – Most of the Commercial Banks under the Banking System in India are SCBs. For example, State Bank of India (SBI), HDFC Bank, etc. | – As of now, there are no NSCB under the Banking System in India. |

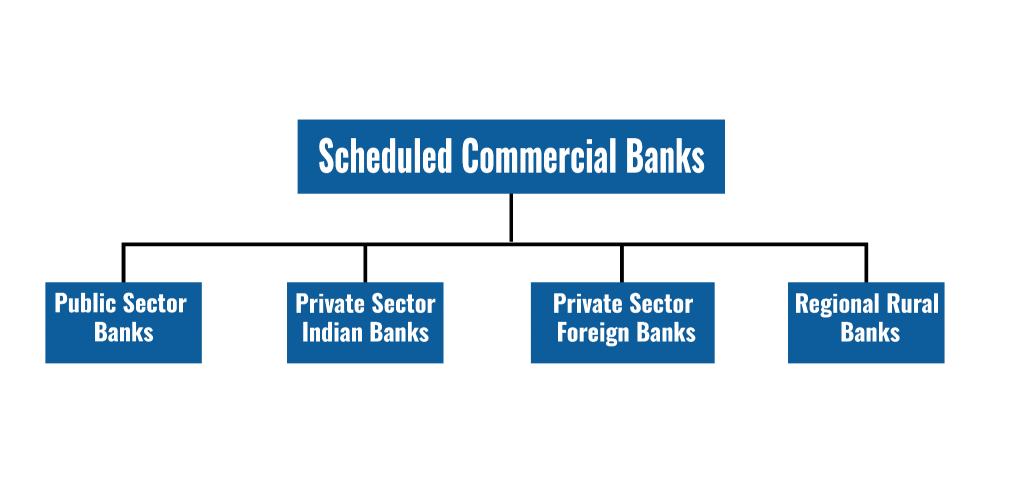

Types of Scheduled Commercial Banks (SCBs)

There are various types of SCBs in India, as can be seen as follows.

| Types of Scheduled Commercial Banks (SCBs) | Majority Shareholder(s) | Example(s) |

|---|---|---|

| Public Sector Banks (PSBs) | Government of India | SBI, PNB, Canara Bank, Bank of Baroda, Bank of India, etc. |

| Private Sector Banks | Private Individuals | ICICI Bank, HDFC Bank, Axis Bank, Kotak Mahindra Bank, Yes Bank etc. |

| Foreign Banks | Foreign Entities | Standard Chartered Bank, Citi Bank, HSBC, Deutsche Bank, BNP Paribas, etc. |

| Regional Rural Banks (RRBs) | Central Government, Concerned State Government, and Sponsor Bank in the ratio of 50:15:35 | Andhra Pradesh Grameena Vikas Bank, Uttranchal Gramin Bank, Prathama Bank, etc. |

Public Sector Banks (PSBs)

- Public Sector Banks (PSBs) are also known as Nationalized Banks.

- They refer to those financial institutions under the Banking System in India where the majority ownership, i.e. more than 50% of the shares, lies with the government.

- Barring the Reserve Bank of India (which is not a ‘bank’ in the technical sense), all other Public Sector Banks were created in India through the process of nationalization of banks in India.

| List of Public Sector Banks (PSBs) or Nationalized Banks in India |

| – State Bank of India (SBI) – Punjab National Bank (PNB) – Bank of Baroda (BoB) – Canara Bank – Central Bank of India – Indian Overseas Bank (IOB) – Union Bank of India (UBI) – Indian Bank – Bank of India – Punjab & Sind Bank – UCO Bank – Bank of Maharashtra |

| Note: – Oriental Bank of Commerce and the United Bank of India have been merged with Punjab National Bank. – Dena Bank and Vijaya Bank have been merged with the Bank of Baroda. |

Private Sector Banks

- Private Sector Banks are those banks under the Indian Banking System in which the private sector has a shareholding of more than 51%. For example, the ICICI Bank, Axis Bank, etc.

- Private Sector Banks, which form part of the Banking System in India, are mainly of two types – Old Private Sector Banks, and New Private Sector Banks.

Old Private Sector Banks

These are banks under the Banking System in India that were left out of the nationalization process (in 1969 and 1980) due to their small size and regional focus.

New Private Sector Banks

These are banks in the Indian Banking System that came into existence after 1991 with the introduction of economic reforms and financial sector reforms. After the adoption of LPG reforms in 1991, the Banking Regulation Act was amended in 1993. It allowed the entry of New Private Sector Banks in the Banking System in India.

Foreign Banks

Foreign Banks refer to those banks that have their headquarters in a different country but operate branches or subsidiaries within India. For example, HSBC, Citi Bank, etc.

Regional Rural Banks

- The concept of Regional Rural Banks (RRBs) was introduced in 1975 on the basis of the recommendations of the Narasimham Working Group (1975).

- They were established as part of the Banking System in India, under the provisions of an Ordinance passed in 1975 and the Regional Rural Banks Act, 1976.

- Some examples of Regional Rural Banks (RRBs) in India include – Paschim Banga Gramin Bank, Andhra Pragathi Grameena Bank, etc.

- These banks aim to fulfill the twin objectives of:

- Providing credit to the weaker sections of society including small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs in rural areas at concessional rates of interest, and

- To mobilize rural savings and channel them for supporting productive activities in the rural areas, check the outflow of rural deposits to urban areas, reduce regional imbalances, and increase rural employment generation.

- The RRBs mobilize deposits primarily from rural and semi-urban areas and provide loans and advances mainly to small & marginal farmers, agricultural laborers, rural artisans, and other such segments of the priority sector.

- Overall, the RRBs are required to provide 75% of their total credit as priority sector lending.

- The RRBs combine the characteristics of a cooperative in terms of familiarity with rural problems and a commercial bank in terms of its professionalism and ability to mobilize financial resources.

- The equity of a Regional Rural Bank is held by the Central Government, the concerned State Government, and the Sponsor Bank in the proportion of 50:15:35.

- Each RRB operates at the regional level in various states and within the local limits as notified by the Government.

- Regional Rural Banks are regulated by RBI and supervised by the National Bank for Agriculture and Rural Development (NABARD).

Importance of Commercial Banks in India

Commercial Banks in India perform several critical functions in the Indian Financial System, which makes them significant for the Indian economy. Some of their crucial functions and significance can be seen as follows:

- Accepting Deposits: They accept various types of deposits from the public which form the main source of funds.

- Providing Loans and Advances: Banks are the primary source of funds for personal finance, agriculture, industrial sectors, and other economic activities through loans and credit facilities.

- Financial Intermediation: They facilitate financial mobility by mobilizing savings from depositors to borrowers, thereby enhancing economic efficiency.

- Financial Inclusion: As the largest category of banking networks in India, they cater to the maximum number of banking customers in India. This aids the cause of Financial Inclusion in India.

- Promotion of Digital Economy: They also provide sophisticated digital banking services that include mobile banking, internet banking, etc. This helps in the promotion of the Digital Economy and makes financial transactions seamless and more accessible to the general public.

Various types of Commercial Banks in India not only support economic growth but also play a significant role in social transformation by promoting financial inclusion. As they continue to evolve, these institutions will remain central to the economic narrative of India, driving future development and fostering a more inclusive economic environment.

FAQs on Commercial Banks

What are Commercial Banks in India?

They are those banks under the Banking System in India that run on a commercial basis and operate to earn a profit.

How many types of Commercial Banks are there in India?

They are of, broadly, two categories – Scheduled and Non-Scheduled. While there is no major Non-Schedule Commercial Bank in India, there are various types of Scheduled Commercial Banks viz – Public Sector Banks (PSBs), Private Sector Indian Banks, Private Sector Foreign Banks, and Regional Rural Banks (RRBs).

Which is the largest Commercial Bank in India?

Based on the branch network and loan portfolio, the State Bank of India (SBI) is the largest Commercial Bank in India.