In News

Sri Lanka inked an agreement with the state-run China Development Bank for a loan of USD 500 million.

About

- This USD 500 million loan is the second installment of the USD 1 billion loan (signed before), out of which USD 500 million was released in 2020.

- Beijing-based Asian Infrastructure Investment Bank (AIIB) also sanctioned Sri Lanka’s request for a $180 million loan.

- Sri Lanka already owes more than $ 5 billion to China from past loans.

Sri Lanka’s Economic Crisis

- Like many pandemic-hit countries, Sri Lanka is facing an acute economic crisis for over a year now.

- Sri Lanka”s foreign exchange reserves dropped to USD 4.05 billion in March 2021, the lowest since a currency crisis in 2008/2009.

- Sri Lanka is due to repay some $ 4.5 billion of its outstanding debt this year

- Sri Lanka hopes that the loan will infuse much-needed foreign currency to its economy in order to face the COVID-19 challenges.

Assistance by India

- India extended a $ 400 million swap facility through the Reserve Bank of India, and provided a three-month rollover.

- The Central Bank of Sri Lanka settled the swap in February 2021.

- While PM Mahinda Rajapaksa sought a debt moratorium on the debt Sri Lanka owes to India, President Gotabaya Rajapaksa requested Prime Minister Modi for a $ 1 billion currency swap last year. Neither request has been cleared as yet.

- Currency Swap Agreement is an arrangement between two friendly countries to involve in trading in their own local currencies.

- As per the arrangements, both countries pay for import and export trade at the predetermined rates of exchange, without bringing in third country currency like the US Dollar.

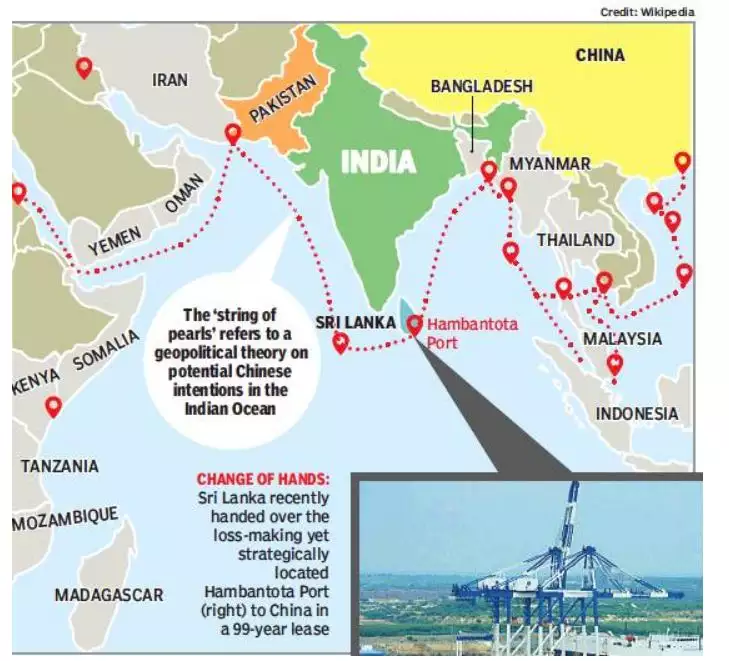

China’s Debt Trap Diplomacy

- In a push to gain rapid political and economic ascendency across the globe, China dispenses billions of dollars in the form of concessional loans to developing countries, mostly for their large-scale infrastructure projects.

- These developing nations, which are primarily low- or middle-income countries, are unable to keep up with the repayments, and China then gets a chance to demand concessions or advantages in exchange for debt relief.

- China views Sri Lanka as a key player in its ambitious Belt and Road Initiative (BRI).

- Massive debt incurred towards China to build the strategic Hambantota Port has been cited by experts as an example of the ”debt-trap diplomacy” being pursued by China.

- After Sri Lanka defaulted the loan for the Hambantota Port, Colombo in 2017 was forced to lease out the port to a Chinese company on a 99-year lease.

Hambantota Port

Image Courtesy: TOI |

Source: TH

Previous article

Chief Election Commissioner

Next article

Decriminalising Beggary in India