Syllabus: GS3/Economy; Environment

Context

India’s approach to the EU Carbon Border Adjustment Mechanism (CBAM), currently focused on seeking exemptions, needs to evolve into a proactive carbon pricing strategy to secure long-term trade competitiveness, fiscal stability, and climate leadership.

| Carbon Border Adjustment Mechanism (CBAM) of European Union 1. It is designed to ensure carbon neutrality in trade, and mirrors the principle of the Value-Added Tax (VAT), a destination-based tax applied where consumption occurs. 2. It is reshaping global trade by imposing a carbon tax on imports of carbon-intensive goods such as steel, cement, aluminum, and fertilizers. 3. It aims to prevent carbon leakage, where companies relocate production to countries with laxer climate regulations and to level the playing field for EU producers subject to strict emissions rules. 4. From January 2026, CBAM will directly link climate policy with economic competitiveness in the European Union (EU). – The United Kingdom has expressed interest in adopting a similar mechanism, and other OECD countries are likely to follow. For India 1. India is a major exporter of steel and aluminum to the EU. 2. CBAM requires exporters to report embedded emissions in their products and, starting in 2026, pay a carbon price equivalent to the EU’s Emissions Trading System (ETS) rate. |

About Carbon Pricing

- It is a policy tool that puts a financial cost on greenhouse gas emissions, primarily carbon dioxide, to incentivize reductions in pollution and promote a shift towards cleaner energy sources.

- It works by making emitters pay for the environmental damage caused by their pollution, encouraging them to reduce emissions.

- The World Bank’s ‘State and Trends of Carbon Pricing 2025’ report has recognized India’s growing role among emerging economies in shaping global climate finance and carbon pricing frameworks.

Why India Needs To Adopt A Robust Carbon Pricing Strategy?

- Structural vulnerability to CBAM: India’s exports, especially steel, aluminum, and cement are among the most carbon-intensive globally.

- They expose exporters to future carbon tariffs once the EU phases in full coverage, while temporary CBAM exemptions may defer compliance costs.

- Indian firms risk double taxation (foreign CBAM and domestic mitigation costs) without domestic carbon pricing.

- Support Economy: In India, only about 23% of Indian steel exports currently qualify for CBAM exemptions.

- It can be neutralized by enabling Indian exporters to claim ‘equivalent carbon cost adjustments’, effectively reducing EU CBAM liabilities.

- A transparent carbon pricing system can convert compliance costs into domestic revenue, rather than EU-bound tax transfers.

- The OECD Green Fiscal Reform Report (2024) estimates India could raise up to 1.5% of GDP annually through carbon taxes or emissions trading, funds that could finance green infrastructure and energy transition programs.

- Industrial Competitiveness & Low-carbon Innovation: According to IEA India Energy Outlook 2024 and TERI Policy Paper on Carbon Pricing (2024), carbon pricing incentivizes energy-intensive firms to invest in low-emission technologies, improving productivity.

- Evidence from South Korea and China shows that carbon markets reduce emission intensity by 10–15% within five years.

- India can future-proof its industries against border taxes while driving innovation in renewables and green hydrogen by internalizing the carbon cost.

- Geopolitical Leverage In Climate Negotiations: A domestic carbon market can signal commitment to global net-zero targets and strengthen India’s negotiating power in G20 and WTO CBAM discussions.

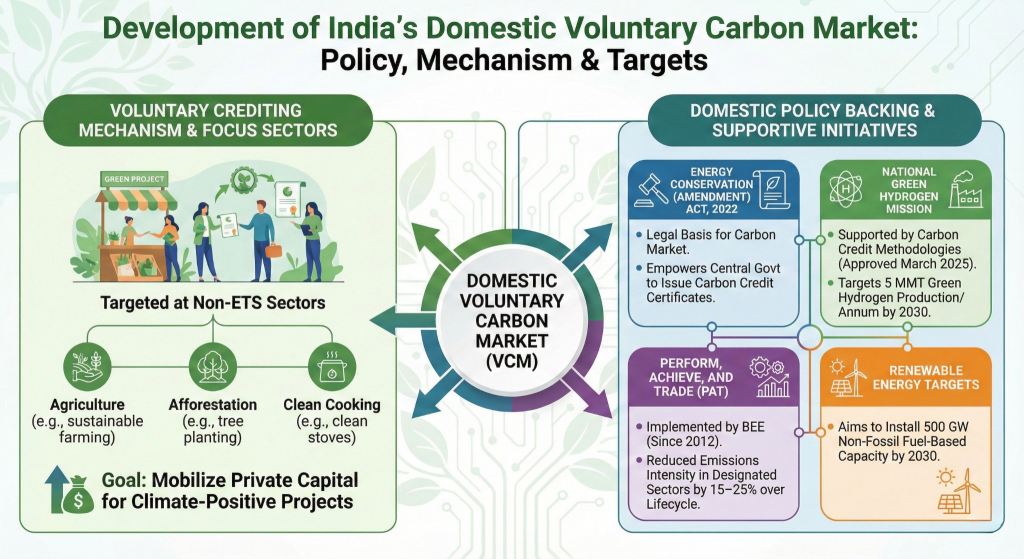

- Institutional readiness: India already has the Perform, Achieve, and Trade (PAT) scheme and Renewable Energy Certificates (RECs), both precursors to a national carbon market under the Energy Conservation (Amendment) Act, 2022.

- Integrating these into a unified carbon pricing framework would allow India to link with global markets by 2030.

India’s Rational Response

- The Carbon Credit Trading Scheme (CCTS): India’s proposed CCTS (set to launch mid-2026) is a step in the right direction. However:

- A cap-and-trade system, while elegant, is institutionally complex.

- It demands strong regulatory capacity and sophisticated financial infrastructure, features that developing economies are still building.

- The Carbon Tax Alternative: A carbon tax offers a simpler, more transparent, and administratively feasible solution.

- It can be integrated with India’s Goods and Services Tax (GST) system.

- It provides price certainty for industries planning long-term investments.

- It ensures that India’s fiscal policy aligns with global decarbonisation trends.

Way Forward: Roadmap for Phased Carbon Pricing in India

- Phase 1: Foundation Building (2025–2027): It includes establishing Legal and Institutional Framework, and setting up a central Carbon Market Authority to oversee design, implementation, and compliance.

- It needs to develop Monitoring, Reporting, Verification (MRV) Infrastructure, and mandate emissions reporting for large industrial emitters across sectors like power, steel, cement, and oil & gas.

- Phase 2: Transition to Compliance Market (2027–2030):

- Launch a National Emissions Trading System (ETS) with a cap-and-trade system for large emitters in key sectors (e.g., power, steel, cement), and introduce Carbon Tax for Non-Covered Sectors like transport and residential.

- Link with International Carbon Markets like EU ETS to allow credit trading and reduce CBAM exposure.

- Phase 3: Expansion and Deepening (2030–2035):

- It includes expanding sectoral coverage in agriculture, aviation, and shipping; increasing carbon price progressively; and strengthening international cooperation.

Conclusion: A Strategic Reset

- The Carbon Border Adjustment Mechanism represents a regime change in the global economic order. For India, success lies in:

- Accepting CBAM as a global norm, not an imposition.

- Implementing a domestic carbon tax to capture revenue and protect exporters.

- Pursuing deep EU integration as a foundation for sustainable trade.

- The CBAM is an opportunity for India to align fiscal policy, trade strategy, and environmental responsibility, marking the true beginning of its green economic transformation far from being a threat.

| Daily Mains Practice Question [Q] Discuss the importance of implementing a carbon pricing mechanism in India. What measures need to be taken to ensure that such a policy aligns with its developmental goals and international climate commitments? |

Previous article

Need To Recalibrate India’s Export Strategy