.jpg)

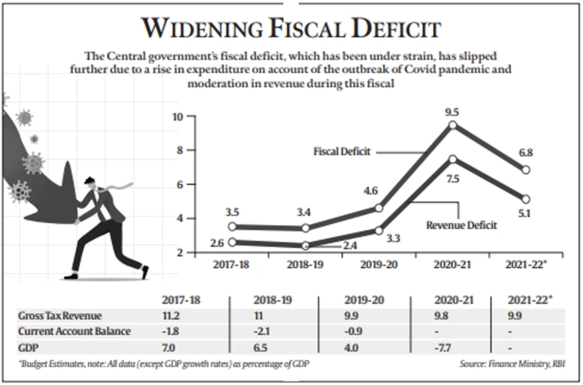

In News: Govt. plots fiscal deficit reduction from 9.5% in FY21 to 4.5% by FY26.

What is the Fiscal Deficit?

Difference between total revenue (excluding money from borrowings) and total expenditure of the government is called the Fiscal Deficit.

- Deficit differs from the debt which is the accumulation of yearly deficits.

|

Fiscal Deficit (FD) =Budget Expenditure – Budget Receipt (Excluding Market Borrowings) |

What is its impact over the economy?

The impact can be classified into two parts:

- Long Term Impact

- Increase in Capital Receipts if Current Capital Expenditure is High.

- Excess sovereign debt. (India GDP-Debt ratio may jump to 90% as per IMF.)

- This leads to Inter-generational disparity in spending capacity.

- In extreme circumstances, it may lead to a Balance of Payment Crisis.

- Short Term Impact:

- Boosts aggregate demand. (This is why Indian Govt has kept FD around 9.5% for 2021)

- Budget deficits may crowd out private borrowing.

- Manipulate capital structures and interest rates.

- The decrease in net exports

- Higher taxes, higher inflation or both

As a thumb rule, the impact may be positive or negative depending on for what purpose, money is being borrowed?:

- If the major chunk is going for Capital Expense, it is beneficial in the long run.

- If a significant portion goes to finance Revenue Deficit, it is a negative sign for the economy.

Ways of financing fiscal deficit:

There are three major ways of Deficit financing: taxing, borrowing or printing money.

- Printing Money

- Also known as Deficit Financing or monetisation of fiscal deficit.

- It is one of the worst ways as it causes high inflation.

- It is not practiced in India at present.

- Increasing Tax

- Increasing tax has always been a lucrative way to finance the deficit.

- Germany and few other developed nations have high rates of taxes.

- Indian problem is small tax base and tax evasions (Only 1 per cent of the Indian population pays income tax and declares earnings above the non-taxable income)

- Increasing tax rates may lead to further shrinkage in tax base as per the Laffer Curve

- Hence, India should focus on increasing the tax base and tax compliance by simplifying and easing Norms and Returns Filing System.

- Borrowing

- The borrowing can be from two sources: International market and Domestic market

- International borrowings may devalue the rupee whereas domestic borrowings may create crowding-out effects.

- This method can be adopted but with caution to keep the total debt within check as per FRMB Act 2002.

- Other Ways: Disinvestment

- In the pre-liberal era, disinvestment was seen as selling families silver.

- But in the present scenario, it is one of the principal policies of the government due to the changing perception of the Government as facilitator.

Steps for fiscal consolidation in light in Union Budget:

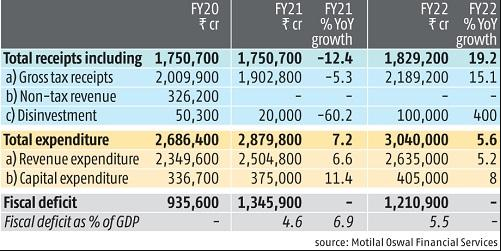

- Fiscal Deficit Targets Breached: Due to COVID 19, the deficit has shot up to 9.5% (Target was 3.5%) which will be eventually brought down to 4.5% by the fiscal year 2026

- Food Subsidy Bill: It has been brought to rationalise and reduce the food subsidy burden on the Government. The new amendment proposes a one-time payment of Rs 2 lakh crore to Food Corporation of India (FCI) to deal with its borrowings from National Small Saving Fund.

- FCI has borrowed nearly Rs 2 lakh crore from NSSF which will form nearly 1% out of 9.5% fiscal deficit.

- FRBM Amendment to reflect changes in fiscal consolidation roadmap: Centre has proposed recovery by

- higher tax buoyancy through improved compliance

- increased monetisation of its assets, including Public Sector Enterprises and land.

- augmentation of the Contingency Fund of India from ?500 crore to ?30,000 crore.

- As recommended by the 15th Financial Commission, states are being allowed

- a net borrowing ceiling of 4% of GSDP in 2021-22, and

- will be expected to consolidate their fiscal deficits to 3% of GSDP by 2021-22.

- Further, the Government wants to borrow for Capital Expenditure focussed on Physical Infrastructure.

Way Forward:

Keynes advocated a countercyclical fiscal policy in which, during periods of economic woe, the government should undertake deficit spending to make up for the decline in investment and boost consumer spending in order to stabilize aggregate demand. The budget by breaching FRBM Act is trying to boost demand and hence restart the wheels of economic prosperity and development of India.

Source: TH